home loan lending calculator insights and pitfalls to avoid

How to use it well

A home loan lending calculator helps estimate repayments by combining principal, interest rate, loan term, and fees. Start by entering realistic numbers, then toggle repayment frequency to see how monthly versus fortnightly changes interest. Check whether compounding is monthly and whether the tool includes offset or extra repayments; those settings materially shift results.

Common mistakes to avoid

Many people trust the first figure they see. That’s risky. Calculators often exclude lender fees, mortgage insurance, and taxes, or assume an introductory rate never ends. Others ignore rate rises or forget to model a buffer. Always read the assumptions, and generate the amortization breakdown to verify how much goes to interest versus principal.

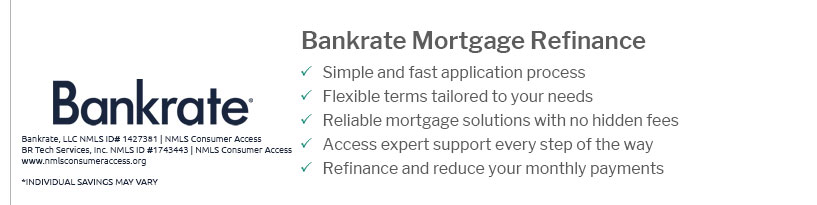

- Forgetting establishment, ongoing, and discharge fees

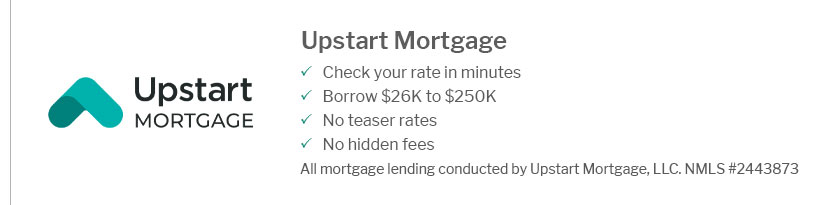

- Using teaser rates instead of a comparison rate

- Not stress-testing by +2% to +3% interest

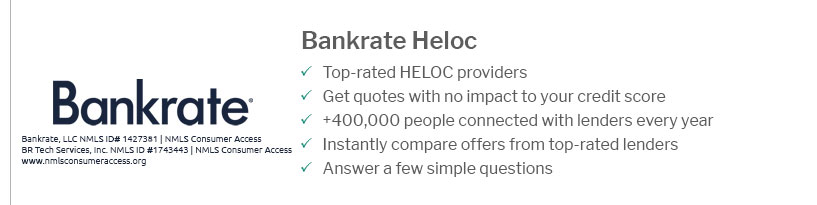

- Leaving extra repayments and offset balances at zero

- Mismatching repayment frequency with your pay cycle

Quick tips

Run two or three scenarios, save the results, and compare. Revisit monthly as rates move, and let the calculator guide conversations with lenders-not replace them.